The space race takes off

Humankind has been fascinated by space for millennia and has been actively exploring it for decades. But as we enter the 2020s, our involvement in the world beyond this planet has never been stronger and the opportunity to benefit from enabling that involvement has never been greater.

Public spending on space reached an estimated $75bn in 2017, the most it has been since the Apollo era of the 1960s according to the Organisation for Economic Cooperation and Development (OECD). A record number of countries and commercial firms are investing in space programmes, with more than 80 countries already having satellites in orbit. In 2018, there were 114 orbital launches, the most since 2000. Almost 900 very small satellites have been launched over the five years to the end of 2018. Over the next five years, eight space agencies plan more than 15 missions to the Moon.

Why this interest in space? Well, it turns out that putting satellites in orbit is incredibly useful for life here on the ground. More than half of the most important climate variables needed for weather forecasting rely on satellite data, and the resultant forecasts help us manage many critical activities on land and at sea.

The utility of earth observation satellites is so high that access to their facilities is increasingly becoming a part of official aid packages for developing countries, where the data they gather can have a positive impact on issues such as land management, climate change mitigation and agriculture.

Positioning and navigation services are another major benefit of space. Many smartphones can now access at least two of the four global navigation satellite systems (GNSS), operated by the US, Russia, Europe, and China. Given their strategic importance, regional satellite navigation services are also being introduced in India, Japan, and South Korea. And although we’re used to thinking of these services as delivering positioning and navigation services, they're equally important as a source of the globally coordinated, accurate timing information needed to run critical infrastructure such as telecoms networks.

|

Satellite broadband subscriptions are growing, and there are plans to develop very large satellite constellations to provide broadband access anywhere on the planet by 2024. In August 2020, the US Federal Communications Commission approved Amazon’s Project Kuiper plan to invest $10bn to launch up to 3,236 satellites to provide global broadband.

There are many other domains, such as government services, defence, transport, weather, environmental management and climate-change monitoring, where space technology is providing benefits such as greater efficiency, cost savings, and the opportunity to avoid costs (think of the value of being able to predict and act against the threat of flooding, for example).

The innovation opportunity

There will always be innovation in space technology, but we are currently in a phase of rapid change, with the uptake of techniques such as small and micro satellites, the implementation of very large constellations, and the development of lower-cost launch options. We are also seeing the emergence of a new crop of space technology start-ups. The OECD estimates that more than 500 small companies, in the US, Europe, Japan, China and India, have been started over the past four years, some providing new space technologies, and other new services such as better ways to analyse data.

Some of the drivers for space innovation include the disruption caused by the general shift to more digital ways of undertaking science, R&D, and manufacturing. This has created opportunities to introduce strategies such as lean development and production processes and enabled greater end-to-end integration of products and services. Satellite manufacture, formerly a fairly bespoke activity, is now also introducing mass-production strategies.

All this transformation is likely to bring other changes to the space industry, such as the restructuring of current value chains, greater competition, and, eventually, consolidation at all levels through mergers and acquisitions.

The OECD recommends that governments should increase their use of commercial space services, through co-funding projects and targeted procurement strategies, to foster space innovation.

Much like putting prestige brands in a prominent position in a shopping centre to entice other companies to move in, governments can act as ‘anchor tenants’ for new space services.

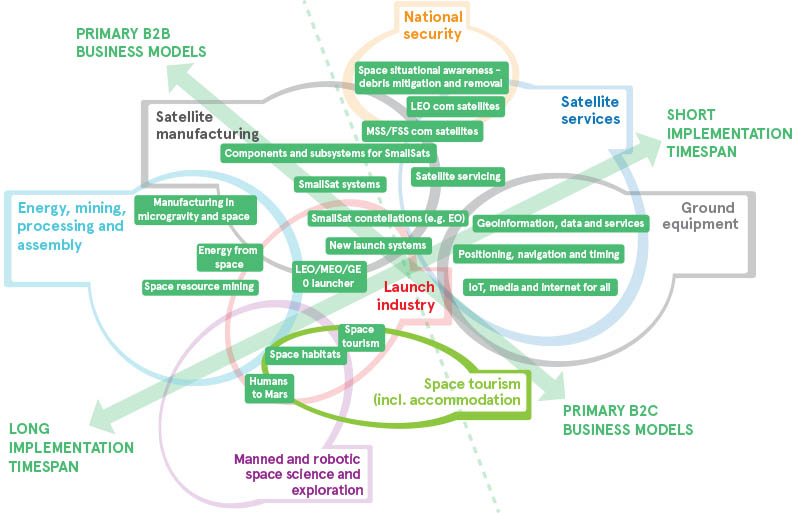

A landscape of space business services, models and segments (Source: Europa.eu)

Europe’s response

Europe has long been involved in space technology. In 2016 the Commission introduced its Space Strategy for Europe, which lays out how it sees the bloc benefiting from increased space activity. Part of the strategy is to strengthen employment and industrial growth in Europe: the Commission estimated that the space sector provides more than 230,000 EU jobs and is worth between €46bn and €54bn to the EU economy. The Commission also wants to see space helping the bloc to address socio-economic issues, accelerate innovation, and increase its autonomy.

It points to three flagship space programmes: the Copernicus earth observation data satellites; the Galileo GNSS service, whose enhanced accuracy and reliability will make it an enabler for autonomous vehicles; and the European Geostationary Navigation Overlay Service, which provides critical navigation services to air, sea and land-based users across Europe.

Having built this infrastructure, the Commission wants to ensure Europe gets the most out of it by encouraging both the public and private sectors to use it. The Space Strategy for Europe therefore calls for greater uptake of Galileo services, easier access to space-based

datasets, support for the creation of more European space start-ups, greater autonomy through the development of European launch vehicles, and more international cooperation.

'New Space'

Europe’s thinking about space has evolved since the Commission’s 2016 Strategy report. In 2019 the European Investment Bank (EIB) published a report and recommendations about the future of the European space sector. It described the concept of New Space – “a global trend encompassing an emerging investment philosophy and a series of technological advancements leading to the development of a private space industry largely driven by commercial motivations.”

Europe’s ability to join this trend is limited by a couple of factors: it is not as strong as the US in the ‘upstream’ activities of developing satellite technology and launching it; and it has limited access to investors who will risk their money on developing or scaling up very new technology. The report estimates that around two-thirds of the 400+ global investors in space companies are from the US.

The EIB report also maps out the relationship between investment risk and space-sector business models and found that business-to-consumer models that can be implemented quickly are less risky and therefore more likely to be funded than longer-term business-tobusiness approaches.

The report makes a number of recommendations to boost private investment in European space technology, but the risk mapping shown in the EIB figure above suggests that the best place to invest is in satellite services and ground equipment developments, especially if they can be quickly implemented.

The engineering challenges

While policymakers sort out how they are going to support European space innovation, engineers will have to do their design and development in an increasingly competitive environment driven by declining costs for launches, pressure to reduce development cycles, and a focus on lower-risk business models. They will have to absorb the impact of broad technological trends such as digitalisation, which will involve deploying more sensors and the management of the resultant data streams. There will also be pressure to reduce complexity, especially in small satellites, to cut costs and boost reliability.

Space design is challenging because the operating environment is so unforgiving. Developers will have to respond to the implications of New Space strategies while continuing to manage traditional space design issues such as reliability, resistance to mechanical shock, extreme thermal environments, the criticality of materials choices, and the effects of radiation on the operating lifetime of sophisticated electronics.

However, there may be opportunities to achieve the required systemic performance through innovative thinking. For example, it may be possible to relax radiation-hardening requirements in some components if they are destined for satellites that will only remain in low-earth orbits for relatively short operating lifetimes. It may also be possible to take a hybrid approach to component choices, so that critical devices such as analogue to digital converters are specified as rad-hard devices, but the onward digital data processing is done by lower-spec parts. And architectural changes, such as implementing triple redundancy and voting schemes, may make it possible to substitute lower-cost commercial processors for more costly space-grade parts.

Some component makers are already responding to this trend by launching uprated versions of Commercial Off-The-Shelf (COTS) parts for use in space. AVX, for example, offers a range of COTS parts plus conductive polymer capacitors. They are made in a facility qualified by the European Space Agency and have gone through statistical screening and accelerated ageing processes to bring them up to spec for use in space. Similarly, Harwin is offering RFI-shielding board-level clips and cans for use in everything from home energy meters to space applications.

In other application areas, only true space-qualified components will do. For example, Harwin’s high reliability 10A connectors are designed to meet NASA’s standard for limiting the amount that component materials outgas when they’re used in a vacuum.

Vishay’s low-profile, high-current IHLP inductors come in a rugged package, are magnetically shielded and will operate at temperatures of up to +180°C. The inductors meet the space reliability requirements of MIL-STD-981 class S. Perhaps this is one of the most challenging things about working on space electronics: designers may need to spend as much time understanding the standards and the ways in which their component choices implement that standard (for example, MIL-STD-981 has multiple sub-categories with different requirements for specific applications) as they do on designing the circuits that use them.

As the space sector continues to grow and diversify, engineers will play a key role in developing the technology that will enable new insights into our planet, as well as the development of new products and services. Looking outward to space may also turn out to be one of the most important ways in which we can look inward, towards our planet and the existential challenges that it, and we, face.

If you have a question and want to discuss it with one of our technical specialists, get in touch here. Alternatively, learn more about our aerospace and defence solutions here.

Ask an expert

Have a question? Our regional technical specialists are on hand to help.

Focus magazine

Aerospace and defence: new frontiers in innovation

In this edition, we investigate the new challenges and opportunities faced by engineers in aerospace and defence applications, looking at what is common across the sector and what is unique to each sub-segment.